Decreasing Term Life Insurance For Mortgage

Decreasing term life insurance is tied to a debt, like a mortgage or loan. With mortgage life insurance you select a large payout amount that could be in line with the loan you want to cover at the beginning of the policy.

How Tax Deductions Work Financial advisors, This or that

How long until your mortgage is paid off).

Decreasing term life insurance for mortgage. Decreasing life insurance is usually taken out alongside a mortgage. The death benefit will decrease on a monthly or annual basis. A decreasing term mortgage policy can help you pay off your mortgage because the death benefits are specifically designed to decrease as you pay down the principal.

Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage*. Decreasing term insurance is a life insurance product that provides decreasing coverage over the term of the policy. Decreasing term life insurance is, as the name states, a term life insurance policy with a death benefit that shrinks over time.

The amount of mortgage life insurance can be decreasing or level. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance. It’s often used to cover the balance of a repayment mortgage, because the total balance of the mortgage decreases over time and will be paid off in full at the end of the term.

It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. You also agree how much your monthly payments will be and for how long you are covered (e.g. In the event of your death, the life insurance company pays the death benefit directly to the mortgage company.

Level term life insurance may be a better option, as it provides. Although payments stay the same over the term of the policy, how much you pay each month is typically less than for level term life insurance. Advantage of decreasing life insurance.

It's rare for life insurance agents/brokers to sell this type of life insurance. As this debt decreases over time, so will the amount of insurance. Convenience was their major selling point.

This differs to level term life insurance, which will pay out a fixed amount if you die during the term, but costs you more in monthly premiums. We occasionally help homeowners looking for decreasing term mortgage protection policies. A decreasing term mortgage life insurance policy specifically covers the outstanding balance on a mortgage.

These policies were popular before the 2008 housing and economic crisis. What is decreasing term life insurance? Decreasing term life insurance 👪 jun 2021.

You may have also heard it called decreasing term life insurance. While you were completing your home loan paperwork to purchase your. Mortgage protection or decreasing term life insurance is a policy where your cover amount goes down or ‘decreases’ over time which in turn lowers the monthly premiums throughout the duration of the policy.

Decreasing term life insurance is a type of life insurance policy that pays out less over time. The term length is equal to the timeframe of your loan. It could pay out a cash sum if you die or you're diagnosed with a terminal illness with a life expectancy of less than 12 months, during the length of your policy.

A decreasing term life insurance policy is typically cheaper than a level term policy because the death benefit your beneficiaries would receive is reduced over time. This is because the payout reduces each month, similar to your mortgage balance after repayments. The amount you are covered for decreases over the term of your policy, similar to the way a repayment mortgage decreases.

Life auto home health business renter disability commercial auto long term care annuity. Premiums are usually constant throughout the contract, and. Mortgage life insurance is typically bought to cover a mortgage, so in the event of your death your loved ones can pay off your outstanding mortgage.

As the benefit reduces with decreasing term life insurance, the risk to the insurer falls alongside it. Our decreasing cover pays out a single amount that reduces over the term of the policy. What is decreasing term mortgage life insurance?

A decreasing term assurance policy is usually the same as a mortgage term assurance policy. Decreasing term life insurance is often used to cover a specific debt, like a mortgage. Decreasing term life insurance policies were convenient and easy to apply for during the financing process;

Our decreasing life insurance is a type of insurance that's designed to help protect a repayment mortgage. For decreasing mortgage life insurance, the type of mortgage usually covered is a repayment mortgage. Instead, loan officers such as mortgage brokers and f&i managers at car dealerships are the people who traditionally sell this type of life insurance.

Decreasing term life insurance is a special form of term life insurance designed to cover a borrowing obligation. Most people encounter decreasing term life insurance as mortgage protection insurance (mpi). Mpi is a decreasing term life insurance policy that you purchase through your bank and may pay as part of your mortgage.

If you’re steadily paying off your mortgage , in the event of your death your dependants would need less money to cover what remains of it as time goes on. Each year, the payout and mortgage amount would decrease together. It was created with the notion that the insured’s need for coverage will decrease over time, as.

Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. Decreasing term life insurance definition.

Over the duration of the policy the benefit amount will decrease. One of the biggest advantages of decreasing mortgage term assurance is that the policy can be aligned with your mortgage, falling as the value of your outstanding mortgage debt falls over time.

10 Financial Points to Discuss Before Marriage Before

Private Mortgage Insurance What Property Buyers Need to

5 insurance changes to make when you retire Life

Start Health insurance cost, Pay off mortgage early

Tips on insurance InsuranceTips Life insurance facts

Life is too short to be complacent or just go through the

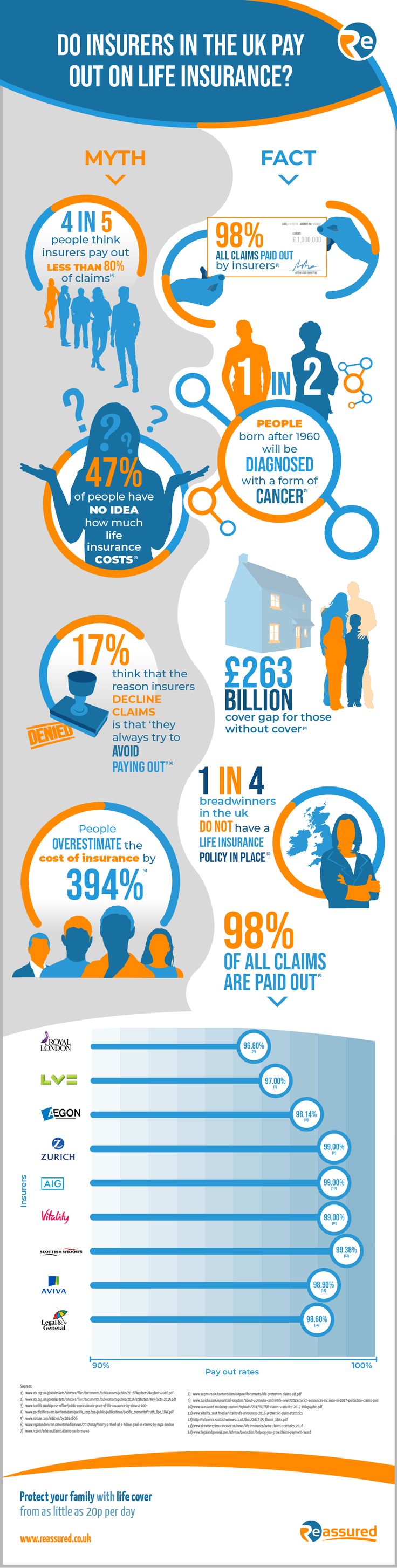

Recent research from a range of sources, including

Some insurance companies offer incentives for paying an

Post a Comment for "Decreasing Term Life Insurance For Mortgage"